Italian Tax Authorities Allow Cumulation of Different Special Tax Regimes for New Italian Residents in the Same Tax Period

Global Mobility of Individuals and Workers. Trends and International Tax Issues

Global Mobility of Individuals and Workers. Trends and International Tax Issues

Global Mobility of Individuals and Workers. Trends and International Tax Issues

The Contents of Highlights & Insights on European Taxation, Issue 12, 2024

Giorgio Beretta January 3, 2025 News & Media The Contents of Highlights & Insights on European Taxation, Issue 12, 2024 Highlights & Insights on European Taxation Please find below a selection of articles published this month (December 2024) in Highlights & Insights on European Taxation, plus one freely accessible article. Highlights & Insights on European Taxation (H&I) is a publication […]

Conference: “Court of Justice of the European Union: Recent VAT Case Law” 22-24 January 2025

Conference: “Court of Justice of the European Union: Recent VAT Case Law” 22-24 January 2025

As perspectivas da reforma tributária e a sua aproximação ao IVA europeu.

As perspectivas da reforma tributária e a sua aproximação ao IVA europeu.

“Aurifer GCC Tax Certificate” the first executive programme on taxation in the Gulf region

The Aurifer GCC Tax Certificate is the first executive programme on taxation in the Gulf region and is accredited by the Dubai Legal Affairs Department (DLAD)

The Contents of Highlights & Insights on European Taxation, Issue 9, 2024

Giorgio Beretta October 9, 2024 News & Media The Contents of Highlights & Insights on European Taxation, Issue 9, 2024 Highlights & Insights on European Taxation Please find below a selection of articles published this month (September 2024) in Highlights & Insights on European Taxation, plus one freely accessible article. Highlights & Insights on European Taxation (H&I) is a publication […]

Congreso “La tributación de las plataformas digitales: retos ante el cambio de paradigma”

LAS PLATAFORMAS DIGITALES COMO ELEMENTO CLAVE EN EL FUTURO DEL IVA

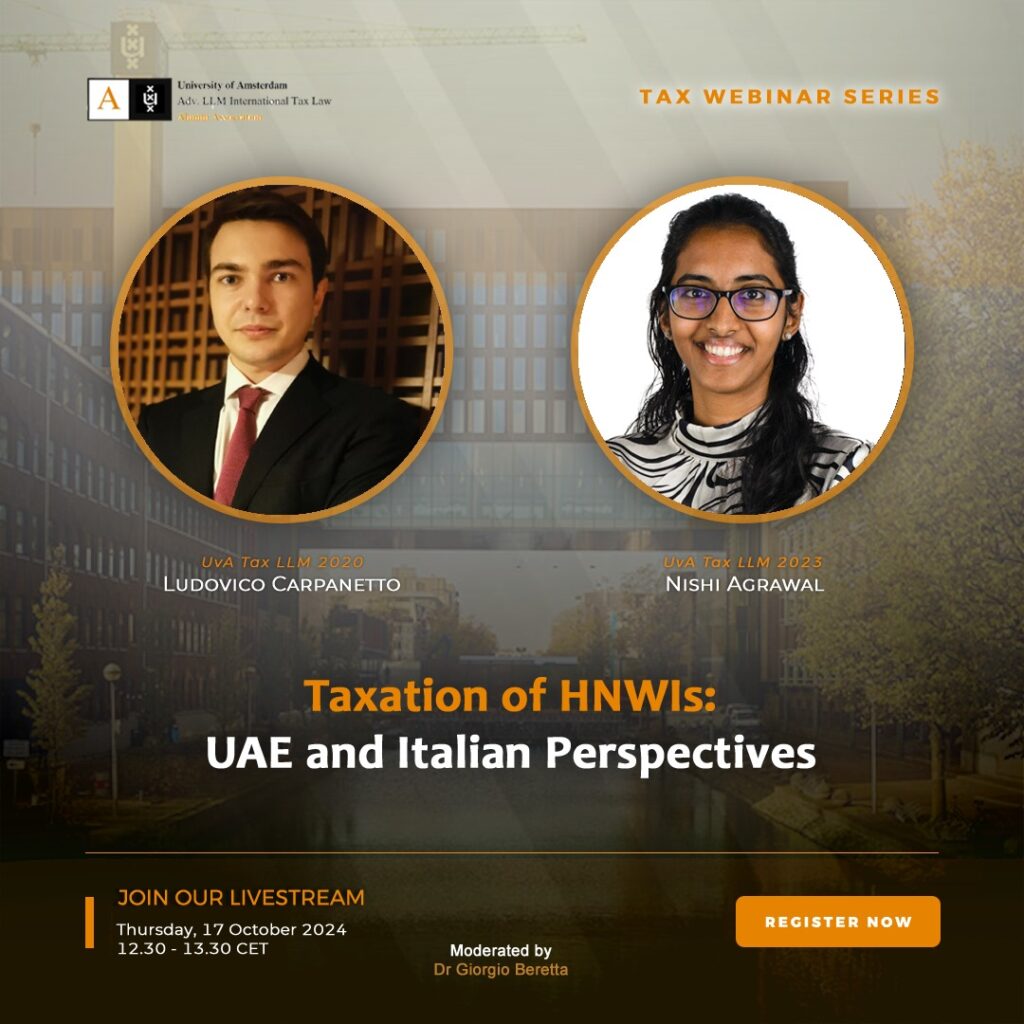

Webinar “Taxation of HNWIs: UAE and Italian Prespectives”

French economist Gabriel Zucman recently proposed levying a 2% tax on the wealth of high-net-worth individuals (HNWIs).

The Contents of Highlights & Insights on European Taxation, Issue 8, 2024

Giorgio Beretta September 2, 2024 News & Media The Contents of Highlights & Insights on European Taxation, Issue 8, 2024 Highlights & Insights on European Taxation Please find below a selection of articles published this month (August 2024) in Highlights & Insights on European Taxation, plus one freely accessible article. Highlights & Insights on European Taxation (H&I) is a publication […]