“Aurifer GCC Tax Certificate” the first executive programme on taxation in the Gulf region

The Aurifer GCC Tax Certificate is the first executive programme on taxation in the Gulf region and is accredited by the Dubai Legal Affairs Department (DLAD)

The Contents of Highlights & Insights on European Taxation, Issue 9, 2024

Giorgio Beretta October 9, 2024 News & Media The Contents of Highlights & Insights on European Taxation, Issue 9, 2024 Highlights & Insights on European Taxation Please find below a selection of articles published this month (September 2024) in Highlights & Insights on European Taxation, plus one freely accessible article. Highlights & Insights on European Taxation (H&I) is a publication […]

Congreso “La tributación de las plataformas digitales: retos ante el cambio de paradigma”

LAS PLATAFORMAS DIGITALES COMO ELEMENTO CLAVE EN EL FUTURO DEL IVA

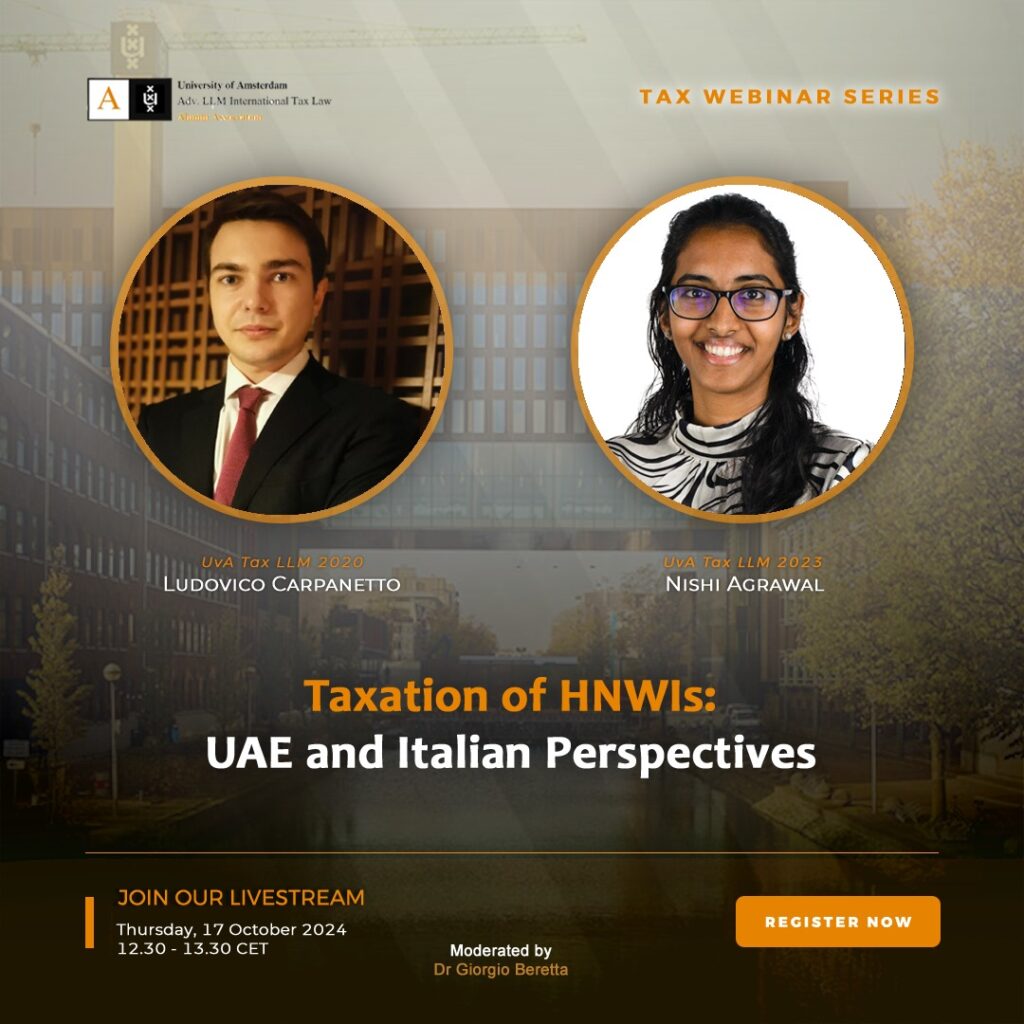

Webinar “Taxation of HNWIs: UAE and Italian Prespectives”

French economist Gabriel Zucman recently proposed levying a 2% tax on the wealth of high-net-worth individuals (HNWIs).

The Contents of Highlights & Insights on European Taxation, Issue 8, 2024

Giorgio Beretta September 2, 2024 News & Media The Contents of Highlights & Insights on European Taxation, Issue 8, 2024 Highlights & Insights on European Taxation Please find below a selection of articles published this month (August 2024) in Highlights & Insights on European Taxation, plus one freely accessible article. Highlights & Insights on European Taxation (H&I) is a publication […]

2024 Mini-Symposium and 2nd Alumni Tax Meeting

On Thursday, 29 August 2024, the Mini-Symposium on International Tax Policy took place in Amsterdam.

The Contents of Highlights & Insights on European Taxation, Issue 7, 2024

Giorgio Beretta September 2, 2024 News & Media The Contents of Highlights & Insights on European Taxation, Issue 8, 2024 Highlights & Insights on European Taxation Please find below a selection of articles published this month (July 2024) in Highlights & Insights on European Taxation, plus one freely accessible article. Highlights & Insights on European Taxation (H&I) is a publication […]

Webinar “Special Tax Regimes for Inward Expatriates: Recent Trends in Selected Jurisdictions”

Professor GIORGIO BERETTA, Professor na Universidade de Amsterdão e a Dra. ROSA FREITAS SOARES, Membro da Coordenação do Nova Tax Research Lab

The Contents of Highlights & Insights on European Taxation, Issue 6, 2024

Giorgio Beretta September 2, 2024 News & Media The Contents of Highlights & Insights on European Taxation, Issue 8, 2024 Highlights & Insights on European Taxation Please find below a selection of articles published this month (June 2024) in Highlights & Insights on European Taxation, plus one freely accessible article. Highlights & Insights on European Taxation (H&I) is a publication […]

Mini symposium on international tax policy and graduation lecture on 29 August 2024

Professor GIORGIO BERETTA, Professor na Universidade de Amsterdão e a Dra. ROSA FREITAS SOARES, Membro da Coordenação do Nova Tax Research Lab