Webinar “Special Tax Regimes for Inward Expatriates: Recent Trends in Selected Jurisdictions”

Professor GIORGIO BERETTA, Professor na Universidade de Amsterdão e a Dra. ROSA FREITAS SOARES, Membro da Coordenação do Nova Tax Research Lab

Mini symposium on international tax policy and graduation lecture on 29 August 2024

Professor GIORGIO BERETTA, Professor na Universidade de Amsterdão e a Dra. ROSA FREITAS SOARES, Membro da Coordenação do Nova Tax Research Lab

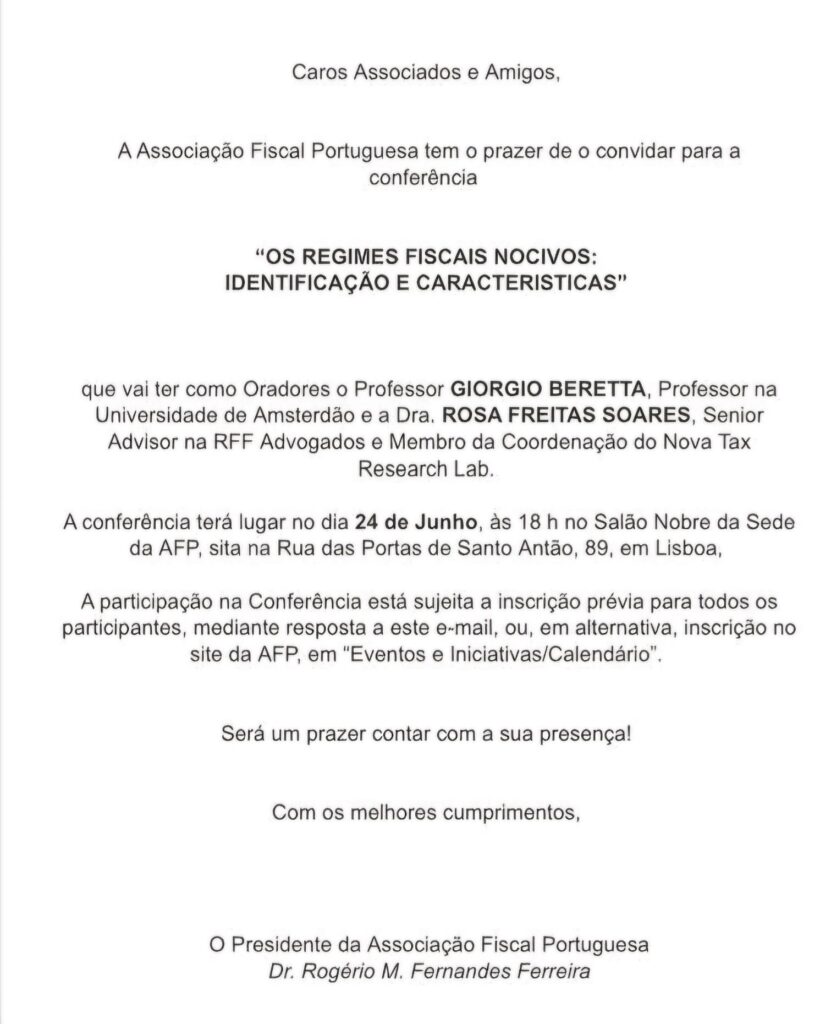

Conferência “OS REGIMES FISCAIS NOCIVOS: IDENTIFICAÇÃO E CARACTERISTICAS”

Professor GIORGIO BERETTA, Professor na Universidade de Amsterdão e a Dra. ROSA FREITAS SOARES, Membro da Coordenação do Nova Tax Research Lab

IBFD Academic Tax Conference – Blueprint for Individual Taxation Reform in a Globalized World

Giorgio Beretta May 24, 2024 News & Media IBFD Academic Tax Conference – Blueprint for Individual Taxation Reform in a Globalized World On 16-17 May 2024, I had the honour with Rosa Freitas Soares to participate as a speaker at the “IBFD Academic Tax Conference – Blueprint for Individual Taxation Reform in a Globalized World”. […]

L’Italia fuori dall’Italia: Giovani italiani ed incentivi (fiscali) a partire e ritornare

Giorgio Beretta March 2, 2024 News & Media L’Italia fuori dall’Italia: Giovani italiani ed incentivi (fiscali) a partire e ritornare Nella storia d’Italia l’emigrazione è stata una costante. Tuttavia, soprattuto a partire dal secondo decennio degli anni Duemila, si è registrato un deciso aumento del deflusso verso l’estero. L’Italia fuori dei confini nazionali è costituita […]

The Treatment Of Virtual Events Under EU VAT

Giorgio Beretta December 29, 2023 Blog The Treatment Of Virtual Events Under EU VAT Virtual events are increasingly common, especially after the repeated lockdowns caused by COVID-19. Indeed, the Court of Justice of the European Union (CJEU) has taken account of the VAT implications of online entertainment activities even before in Geelen (C-568/17), which was decided on […]

Farewell Announcement

Giorgio Beretta December 29, 2023 News & Media Farewell Announcement Dear Estimated Readers, I hope you are enjoying and making the most of your well-deserved Winter holidays! I only disturb your “tax-free” peace to make a short announcement before the closure of 2023 and the beginning of New Year 2024. After four years of mutually […]

Platforms and Tax Information Reporting

Giorgio Beretta February 13, 2023 News & Media Platforms and Tax Information Reporting “Platforms and Tax Information Reporting in the European Legal Framework” is a specialisation course developed by the Amsterdam Centre for Tax Law (ACTL) within the framework of the research project on “Designing the tax system for a Cashless, Platform-based and Technology-driven society” […]

EU Funding for UvA Project on Platforms’ Tax Information Reporting

Giorgio Beretta October 13, 2022 News & Media EU Funding for UvA Project on Platforms’ Tax Information Reporting The Amsterdam Centre for Tax Law (ACTL) of the University of Amsterdam has received EU support to develop a new teaching programme on tax information reporting by online platforms. The ACTL, within its research project on designing […]

Highlights & Insights on European Taxation (H&I) – Year 2022, no. 8

Giorgio Beretta August 31, 2022 News & Media Highlights & Insights on European Taxation (H&I) – Year 2022, no. 8 Please find below a selection of articles published this month (August 2022) in Highlights & Insights on European Taxation , plus one freely accessible article. Highlights & Insights on European Taxation (H&I) is a publication by Wolters Kluwer Nederland BV. The journal […]