Global Mobility of Individuals and Workers. Trends and International Tax Issues

Global Mobility of Individuals and Workers. Trends and International Tax Issues

Conference: “Court of Justice of the European Union: Recent VAT Case Law” 22-24 January 2025

Conference: “Court of Justice of the European Union: Recent VAT Case Law” 22-24 January 2025

As perspectivas da reforma tributária e a sua aproximação ao IVA europeu.

As perspectivas da reforma tributária e a sua aproximação ao IVA europeu.

“Aurifer GCC Tax Certificate” the first executive programme on taxation in the Gulf region

The Aurifer GCC Tax Certificate is the first executive programme on taxation in the Gulf region and is accredited by the Dubai Legal Affairs Department (DLAD)

Congreso “La tributación de las plataformas digitales: retos ante el cambio de paradigma”

LAS PLATAFORMAS DIGITALES COMO ELEMENTO CLAVE EN EL FUTURO DEL IVA

2024 Mini-Symposium and 2nd Alumni Tax Meeting

On Thursday, 29 August 2024, the Mini-Symposium on International Tax Policy took place in Amsterdam.

Mini symposium on international tax policy and graduation lecture on 29 August 2024

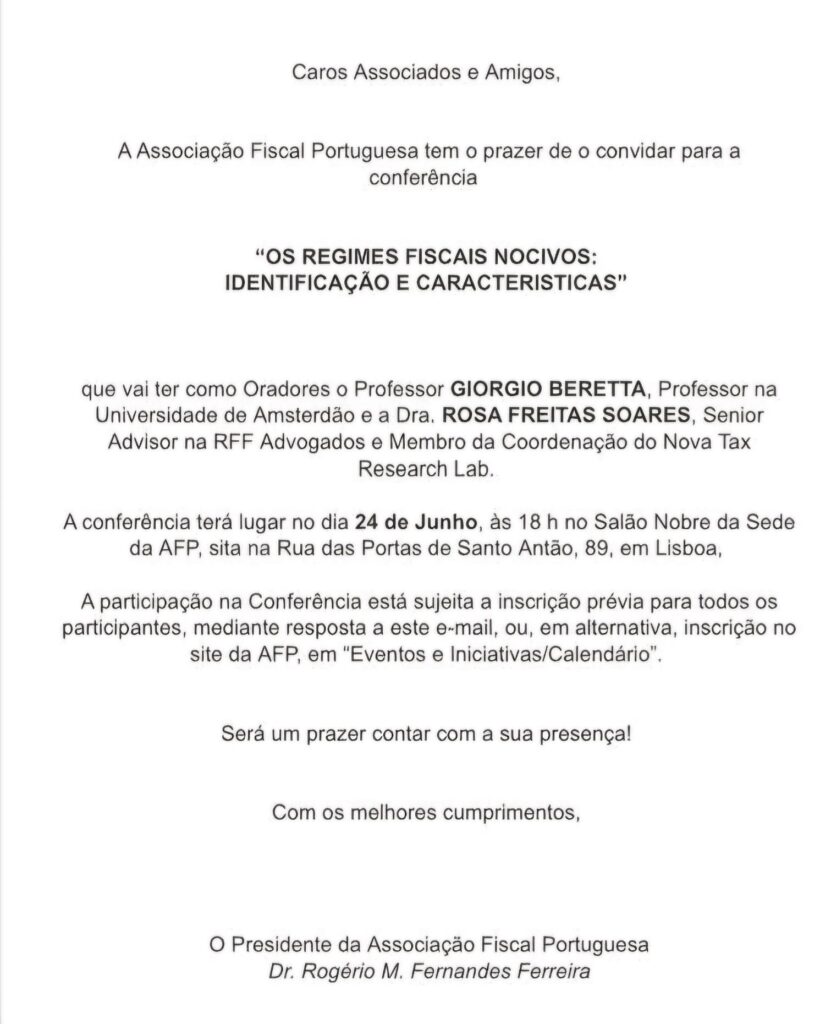

Professor GIORGIO BERETTA, Professor na Universidade de Amsterdão e a Dra. ROSA FREITAS SOARES, Membro da Coordenação do Nova Tax Research Lab

Conferência “OS REGIMES FISCAIS NOCIVOS: IDENTIFICAÇÃO E CARACTERISTICAS”

Professor GIORGIO BERETTA, Professor na Universidade de Amsterdão e a Dra. ROSA FREITAS SOARES, Membro da Coordenação do Nova Tax Research Lab

IBFD Academic Tax Conference – Blueprint for Individual Taxation Reform in a Globalized World

Giorgio Beretta September 2, 2024 News & Media The Contents of Highlights & Insights on European Taxation, Issue 8, 2024 On 16-17 May 2024, I had the honour with Rosa Freitas Soares to participate as a speaker at the “IBFD Academic Tax Conference – Blueprint for Individual Taxation Reform in a Globalized World”. During the […]

L’Italia fuori dall’Italia: Giovani italiani ed incentivi (fiscali) a partire e ritornare

Giorgio Beretta September 2, 2024 News & Media The Contents of Highlights & Insights on European Taxation, Issue 8, 2024 Nella storia d’Italia l’emigrazione è stata una costante. Tuttavia, soprattuto a partire dal secondo decennio degli anni Duemila, si è registrato un deciso aumento del deflusso verso l’estero. L’Italia fuori dei confini nazionali è costituita […]